Book Value: Definition, Meaning, Formula, and Examples

Content

After all, there’s a chance that the values have increased significantly over time. It’s also possible that a given company has liens applied against its assets, or is facing lawsuits that, if lost, could inflict losses that erode a large amount of its balance sheet value. In sum, there’s no foolproof guarantee of investment returns, or investment safety, at a certain P/B level. A low P/B ratio usually suggests that a company, or its industry, or both, are out of favour.

Sterling Infrastructure has a projected 3-5-year EPS growth rate of 18%. Sterling Infrastructure currently has a Zacks Rank #2 and a Value Score of A. HT currently carries a Zacks Rank #2 and has a Value Score of A. It also has an impressive five-year expected growth rate of 52.85%. Signet Jewelersis a retailer of diamond jewelry, watches as well as other products. The company operates in the United States, Canada, the U.K., the Republic of Ireland and the Channel Islands.

Business Case Studies

To find the equity, you should subtract the company’s liabilities from its assets. Preferred equity is money owed to preferred shareholders that have an invested stake in the company and are paid dividends first at a fixed rate. It doesn’t take into account intangible assets and it focuses on historical costs rather than current stock price values. The shareholders’ equity book value alone doesn’t provide one with adequate data regarding a company’s potential return and real value.

On the other hand, if a company’s shares are in low demand, it is likely to have bad future prospects. Another way to think about the difference is that book value is a measure of a company’s financial health while market value is a measure of a company’s market popularity. To record an appropriation of retained earnings, the account Retained Earnings is debited , and Appropriated Retained Earnings is credited . Using the same share basis formula, we can calculate the book value per share of Company B. Even though book value per share isn’t perfect, it’s still a useful metric to keep in mind when you’re analyzing potential investments.

The Difference Between Book Value and Market Value

The book value per share is fixed, but the market value per share fluctuates. The MVPS of the company increases with the increase stock book value in its income and vice-versa. Market value per share is defined as the current price of the single share in the market.

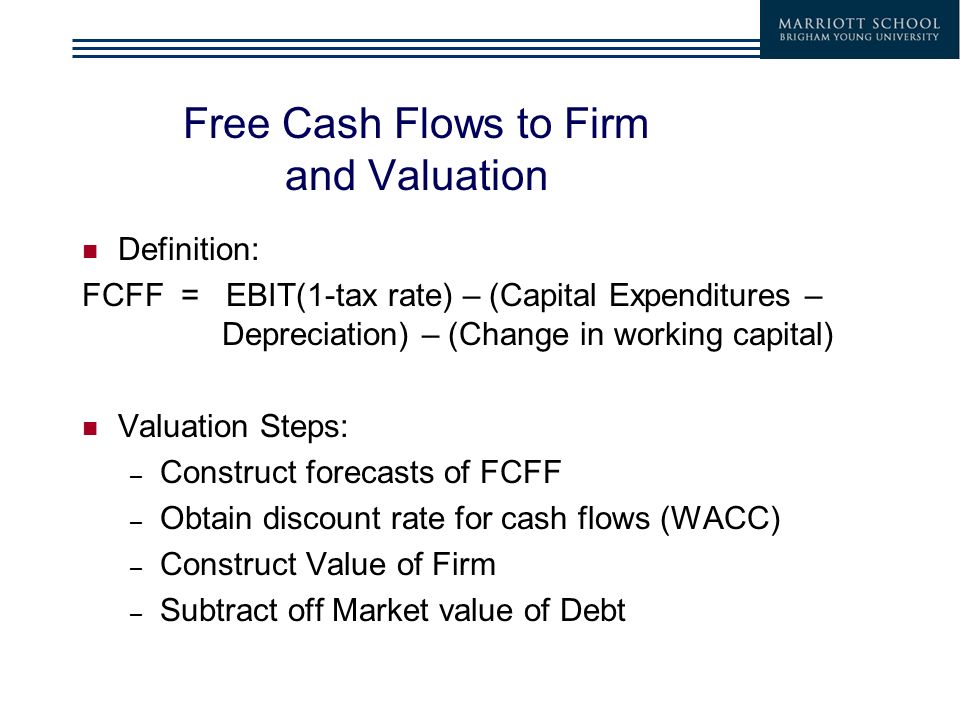

How to Invest in Stocks Are you ready to jump into the stock market? For the initial outlay of an investment, book value may be net or gross of expenses such as trading costs, sales taxes, service charges, and so on. The price-to-book (P/B) ratio evaluates a firm’s market value relative to its book value. A higher market value than book value means the market is assigning a high value to the company due to expected earnings increases. Chris B. Murphy is an editor and financial writer with more than 15 years of experience covering banking and the financial markets. Stockopedia contains every insight, tool and resource you need to sort the super stocks from the falling stars.

![]()